SCAMS

Be Aware Of Sim Swapping Fraud – SIM swapping is where a fraudster gains control of your mobile phone number by transferring the service to a SIM in their possession. They will gather personal details about you and this can be from phishing emails, viewing your social media posts, social engineering and more. Once they have sufficient information they will pretend to be you by using the information they have gained to pass the security checks that your provider may request. Following this they will ask them to route your phone number to their own SIM which will give them access to any incoming calls and text messages, including one-time-passwords to gain access to your financial and social media accounts.

If you think your SIM card has been swapped or if you receive any texts or emails regarding a PAC request or your SIM being ported contact your network provider straight away. Ask them to secure your mobile account and find out what future protection is available. Inform your banks as soon as a matter of urgency to prevent fraudsters attempting to make and unauthorised transactions from your account with a money transfer online or over the phone. Suffolk Trading Standards advise you to avoid oversharing your personal details on social media like your birth date or common password recovery phrases like the name of your pet or school. Setting up a Two Step Verification (2SV) can help to protect you against from being scammed. Report all scams to Suffolk Trading Standards on 0808 223 1133

Report Scams by using British Sign language Action Fraud have teamed up with SignVideo to create a ‘Fraud Reporting Service’ which is accessible for British Sign Language users. You can download the FREE Sign Video app on the Sign Video website, click on the Sign Directory and search for ‘Action Fraud’, to connect to a BSL interpreter.

Stop Nuisance Calls and Texts If you are receiving nuisance calls or texts that you don’t want from cold callers or recorded automated messages relating to PPI or accidents etc, the Citzens Advice Bureau have advised there are some actions you can take to stop them. For example, registering with the Telephone Preference Service, blocking calls or reporting them to the Information Commissioner’s Office. To find out more click on the image below to go their website.

Email 2 step Security Your email account is a gateway to your online activity and a source of information that criminals can use for identity fraud. To stay safe you can use a simple 2 step verification security. To find out more information on how to set up the 2 step process, visit the Cyber Aware website

- QR Code Scam A warning from Suffolk Trading Standards for everyone to be aware of a new QR Code Scam that aims to trick you into scanning a fake QR code with your phone/device. Once scanned it will take you to a fraudulent website designed to obtain your personal and financial information. QR codes can be found on in many places including parking machines, charging points, emails and more Once scanned, you will not knowingly be inputting your all your details to pay for a service when in fact, you’re will be providing scammers with the opportunity to gain access to your hard earned money.Suffolk Trading Standards have issued the following advice to help you avoid being caught out.

If the QR code is on a poster in a public area, always check whether it appears to have been stuck over the original. If the sign or notice is laminated and the QR code is under the lamination or part of the original print, chances are it’s more likely to be genuine

If in doubt, download the app from the official Google or Apple store or search the website on your phone’s internet browser, rather than scanning a QR code to take you there. It may take longer, but it’s more secure

Check the preview of the QR code’s URL to see if it appears legitimate. Make sure the website uses HTTPS rather than HTTP, doesn’t have obvious misspellings and has a trusted domain

Trust your instincts. If something doesn’t seem right, don’t share your details

Apple iCloud Storage Fraud Beware of emails which appear to be from Apple claiming that your iCloud storage is full. These are sent via phising websites that are designed to steal your Apple ID log in details as well as personal and financial information. Make a quick tap on the sender’s address and it will reveal that it is not from an office Apple email address. Report scam emails to report@phishing.gov.uk and suspicious websites to the National Cyber Security Centre. If you have been a victim of a phising email and have had money taken or your personal information has been compromised notify your bank immediately and report it to Action Fraud

Scam Action Service Online scams are increasing and becoming more sophisticated. As part of the Citizens Advice Scam Action Service, there is now advice available online to help you spot scans and stay protected. Alternatively you can call them Monday – Friday, 9am – 5pm on 0300 330 3003 Find out more https://citizensadvice.org.uk/ScamsAction/

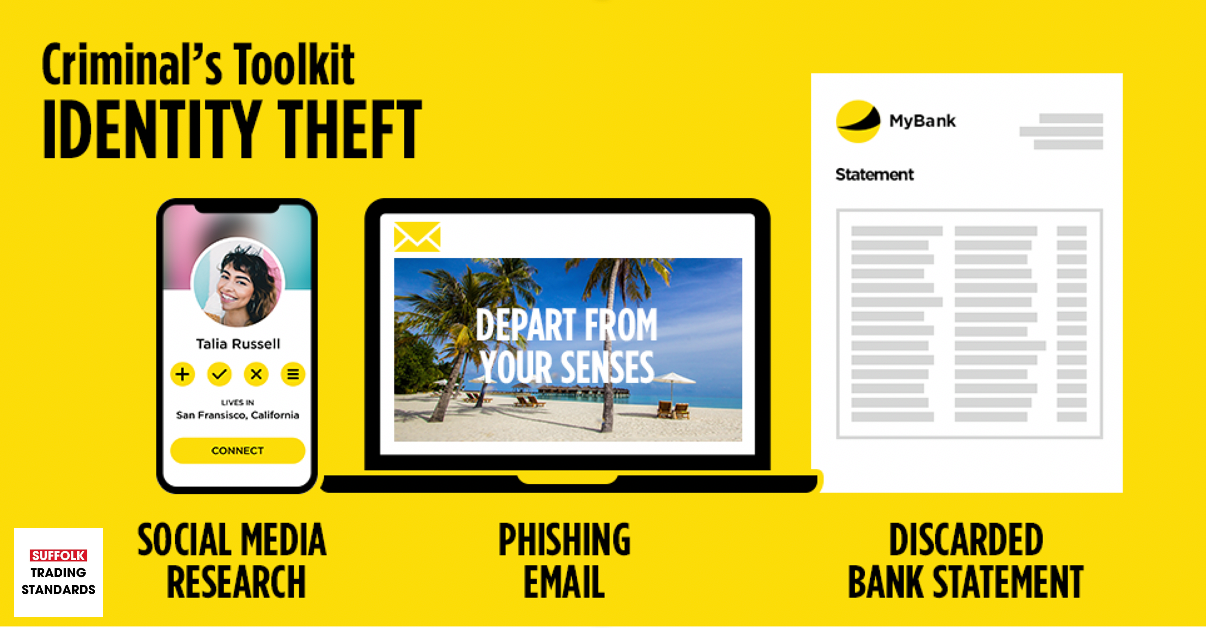

Protect Yourself Against Identity Theft Suffolk Trading Standards are advising everyone to be more aware of the personal information that they throw away or give out to others to prevent becoming a victim ofIdentity theft. Criminals will gather information about you over time until they know enough about you to use it to steal your identity and apply for credit cards, loans, driving licence or passport in your name. Please #TakeFive to think before discarding documents such as old bank statements and be careful of the personal information that you share on social media.

Follow the 3 steps to protect yourself:

1 Destroy unwanted documents including bills, bank statements or post that’s in your name, preferably by using a shedder.

2 Request copies of your personal credit report from a credit reference agency on a regular basis to check for any entries you don’t recognise.

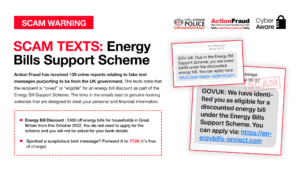

3 Provide as little personal information about yourself on social media as possible and only accept invitations from people you know.Energy Bills Text Scam Action Fraud have advised they have received reports relating to fake text messages regarding the Energy Bills Support Scheme. You DO NOT need to apply for the scheme, and Never provide any bank or finaicial information. Forward any texts you you receive for free to 7726 and for more information, please visit: https://www.gov.uk/…/getting-the-energy-bills-support…

Pension Scam £1.8 million has already been lost this year due to pension fraud and Action Fraud are asking everyone with a pension to be vigilant. Pension scams will often include a free pension reviews and “too good to be true” investments and even early release money from your pension. Find out more by visiting the Action Fraud website.

Can you spot the difference? A Genuine request or a scam? Criminals posing as your bank can trick you into updating your personal details through links provided in the text messages. They can be embedded into genuine message threads making it increasingly difficult to spot. Stop and think #TakeFive and log into your account directly to update your personal information. If you are worried you may have fallen for a scam, contact your bank straight away and report it to Action Fraud by forwarding any scam texts to 7726 or by calling 0808 223 1133.